Latest Posts On How2Invest:

How2Invest A Detailed Guidelines:

So, If you are unaware of this platform then you are missing out an amazing platform abut the investment.

Basically, How2Invest is a cutting-edge investment platform that offers a wide array of investment options, ranging from stocks, ETFs, and Real Estate investment trusts to mutual funds and bonds.

Don’t worry of you want to know further details about this platform, Because we are going to share every minute details with you guys. So, Stick With Us!

What Is How2Invest and Its Purpose? – For Those Who Don’t Know!

How to invest is a platform where you’ll have so many investment options and the security they have provide is also amazing. You can have Stocks and Shares, ETFs, Real estate, and so many other options.

With a user-friendly interface and expert-backed guidance, How2Invest empowers both beginners and seasoned investors to make well-informed decisions, diversify their portfolios, and pursue financial growth with confidence.

How2Invest is a leading online investment platform that connects investors with various financial instruments. Its primary purpose is to empower individuals to achieve their financial goals through informed investments.

Whether you’re interested in stocks, bonds, real estate, or cryptocurrencies, How2Invest aims to provide a user-friendly interface that caters to diverse investment needs.

What Are the Different Types of Investments Available with How2Invest?

Stocks and Shares Of How2Invest:

Stocks and shares represent ownership in a company. When you invest in stocks through How2Invest, you become a shareholder and have the potential to benefit from the company’s growth and profitability.

However, it’s essential to be mindful of market fluctuations and conduct thorough research before making investment decisions.

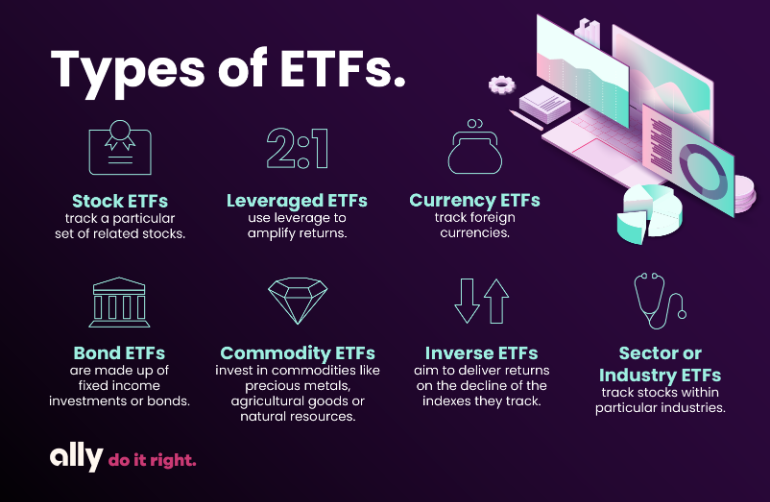

How 2 Invest ETFs (Exchange Traded Funds):

Exchange Traded Funds (ETFs) offer a convenient way to diversify your investment portfolio. ETFs pool money from multiple investors and invest in a diversified basket of assets, such as stocks, bonds, or commodities.

How2Invest provides access to a wide range of ETFs, making it easier to invest across various sectors and industries.

Real Estate Investment Trusts (REITs) Of How2Invest.com:

For those interested in real estate without the hassle of property management, REITs are an attractive option.

Through How2Invest, you can invest in REITs, which are companies that own or finance income-generating real estate. These investments can offer steady returns and diversify your investment portfolio beyond traditional stocks and bonds.

Mutual Funds By How2Invest:

Mutual funds are professionally managed investment funds that pool money from multiple investors to purchase a diversified portfolio of securities.

How2Invest offers a selection of mutual funds, catering to different risk profiles and investment objectives.

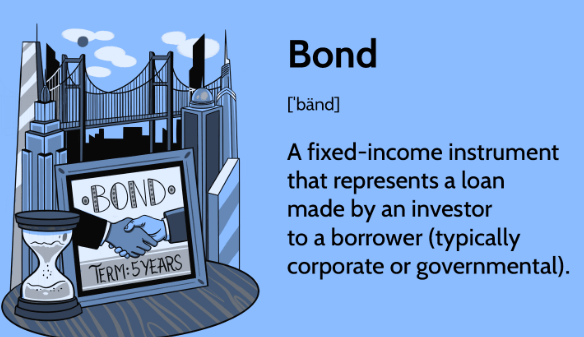

Bonds By How 2 Invest.com:

Bonds are debt securities issued by governments, municipalities, or corporations.

When you invest in bonds through How2Invest, you lend money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

Bonds are generally considered lower-risk investments compared to stocks.

How2Invests Cryptocurrencies:

If you’re intrigued by the world of cryptocurrencies, How2Invest may provide opportunities to invest in digital assets like Bitcoin, Ethereum, or other altcoins.

Cryptocurrencies are known for their volatility, so caution and thorough research are crucial before venturing into this space.

So, these are some of the options that you’ll have on howtoinvest.com. You can invest in any of them which sets best for your interest and can start trading today.

Some Precautions For Investing In How2invest – Must Consider Them!

Balancing The Risk and Reward

Investing always involves an element of risk, and different investment opportunities come with varying levels of risk and potential returns. Higher-risk investments often offer the potential for higher rewards, but they also carry a greater chance of loss.

On the other hand, lower-risk investments may provide more stability but might yield lower returns. Balancing the risk and reward is crucial in building a well-rounded investment portfolio that aligns with your financial objectives and risk tolerance.

Follow These Steps In This Regard!

- Define Your Risk Tolerance for How2Invest: Assess your comfort level with risk. If you have a higher risk tolerance and are comfortable with market fluctuations, you may consider investing in more aggressive assets, such as stocks or cryptocurrencies. If you have a lower risk tolerance, focus on more conservative investments, like bonds or mutual funds.

- Diversify Your Portfolio In Order To Invest In How2invest.com: As mentioned earlier, diversification is a key strategy in balancing risk and reward. By spreading your investments across various asset classes, industries, and geographic regions, you reduce the impact of potential losses from a single investment. How2Invest offers a wide range of investment options, making it easier to achieve diversification.

- Stay Informed: Keep yourself updated on market trends, economic conditions, and any changes that might affect your investments. Understanding the potential risks and rewards associated with each investment can help you make more informed decisions.

Diversification (Do Not Invest In A Single Type of Investment)

Diversification is a risk management strategy that involves spreading your investments across different asset classes and securities.

By diversifying, you reduce the risk of significant losses in the event that one investment performs poorly.

How2Invest provides a diverse selection of investment options, allowing you to build a portfolio that includes stocks, bonds, rlea estate, ETFs, and potentially cryptocurrencies, if available.When diversifying through How2Invest:

- Make sure to collect the Asset Fisrt: Determine the allocation of your investments among different asset classes based on your risk tolerance and investment goals. This allocation will help you achieve the desired balance of risk and return.

- Rebalance Regularly: Periodically review your portfolio and rebalance it as needed. As some investments may outperform or underperform others, rebalancing ensures that your asset allocation remains in line with your investment strategy.

- Stay Disciplined: Avoid making impulsive decisions based on short-term market movements. Stay committed to your long-term investment plan, and avoid making drastic changes unless your financial goals or circumstances change significantly.

Check the Safety and Security of the Platform You Are Investing In

Before committing your funds to How2Invest or any investment platform, verify the platform’s safety measures and security protocols. Ensuring that your investments are protected from potential cyber threats is essential for a secure investment experience.

So, these are some of the precautions that you can do before investing in the how2invest.com. By following these steps and considerations, the how2invest platform will definitely help you.

Suggest Some Risk Management and Investing Strategies in How2Invest

To optimize your investment journey on How2Invest, consider adopting the following risk management and investing strategies:

Dollar-Cost Averaging: Invest a fixed amount at regular intervals (e.g., monthly or quarterly) rather than investing a lump sum all at once.

This strategy helps reduce the impact of market volatility and allows you to buy more shares when prices are lower and fewer shares when prices are higher.

Make Sure You Have Emergency Fund: Before diving into investments, ensure you have an emergency fund in place to cover unforeseen expenses. Having a safety net helps you avoid selling investments during market downturns to meet urgent financial needs.

Investing for the Long Term: Approach your investments with a long-term perspective. Avoid making frequent changes to your portfolio based on short-term market fluctuations. Historically, the stock market has shown positive returns over the long run.

Avoid Chasing Trends: Resist the temptation to invest in the latest hot trend or speculative assets without proper research. Stick to a well-thought-out investment plan based on your financial goals and risk tolerance.

Regular Portfolio Reviews: Periodically review your investment portfolio to ensure it aligns with your financial objectives and risk tolerance. Make adjustments as needed to maintain a well-diversified and balanced portfolio.

Seek Professional Advice: If you’re unsure about investment decisions or need personalized guidance, consider consulting a financial advisor. An advisor can help create a customized investment plan tailored to your specific financial situation and goals.

By implementing these strategies, you can navigate the world of investments with confidence and increase your chances of achieving your financial objectives with How2Invest.

What Is the Best Time to Invest in How2Invest? – Unleash The Truth!

Timing is a crucial factor in the world of investments. While it’s essential to remember that timing the market perfectly is challenging, there are some principles to consider when investing through How2Invest:

- Make sure to do the Long-Term Approach. Instead of trying to time the market, focus on a long-term investment horizon. Over the long run, the ups and downs of the market tend to average out, potentially yielding better returns.

- Check out the Market Research. Stay informed about market trends, economic indicators, and the performance of various asset classes. While market timing may not be precise, staying informed can help you make more informed decisions.

- Avoid Emotional Decisions because Emotional reactions to market fluctuations can lead to impulsive decisions. Stick to your investment plan and avoid making drastic changes based on short-term market movements.

Which One Is the Best Plan Of How2Invest? – Our Recommendations!

Selecting the best plan on How2Invest depends on your individual financial goals, risk tolerance, and investment preferences. How2Invest typically offers a range of plans tailored to different investor profiles. Consider the following factors when choosing the best plan:

Risk Tolerance: Assess your risk tolerance carefully. If you have a higher risk tolerance and seek higher potential returns, a plan with exposure to equities or cryptocurrencies might be suitable. For lower risk tolerance, consider plans that include bonds or other fixed-income instruments.

Investment Goals: Define your investment goals clearly. Are you investing for retirement, buying a home, or creating an emergency fund? Your goals will influence the type of plan that aligns with your objectives.

Time Horizon: Determine your investment time horizon. Short-term goals may necessitate a more conservative approach, while long-term goals may allow for more aggressive investments.

Diversification: Look for plans that offer a well-diversified portfolio of assets. Diversification can help spread risk and optimize potential returns.

Fees and Expenses: Be mindful of the fees and expenses associated with each plan. Lower fees can have a significant impact on your overall returns in the long run.

Professional Advice: If you’re unsure about which plan is best for you, consider seeking advice from a financial advisor. They can provide personalized recommendations based on your unique financial situation and goals.

Remember, the best plan for one investor may not be the best for another. It’s essential to select a plan that aligns with your financial objectives, risk tolerance, and time horizon. Regularly review your investments and make adjustments as needed to stay on track toward achieving your goals.

Heading Towards The End:

In conclusion,

How2Invest is an excellent platform for individuals seeking to build wealth through smart investments. You can ahve so many investing optionns here like investment in stocks amd shares, ETFs, and Real Estate investment trusts to mutual funds and bonds.

So, Whether you’re a seasoned investor or a beginnetr, How2Invest offers a range of investment options to suit your needs. Check The Details and start investing Now!

567gk3: Unlocking Its Meaning, Usage, and Significance

567gk3: Unlocking Its Meaning, Usage, and Significance  Claude Edward Elkins Jr: A Legacy of Compassion and Accomplishments

Claude Edward Elkins Jr: A Legacy of Compassion and Accomplishments  Seekde: Simplifying Content Creation for All Skill Levels

Seekde: Simplifying Content Creation for All Skill Levels  Mac Računala: A Comprehensive Guide to Apple’s Powerful and Elegant Computers

Mac Računala: A Comprehensive Guide to Apple’s Powerful and Elegant Computers  Sosoactive: The Energetic Lifestyle That’s Transforming Health, Business, and Education

Sosoactive: The Energetic Lifestyle That’s Transforming Health, Business, and Education